Becoming obsessed with savings rate is not a unique experience. I’m willing to bet it’s kept many of us awake at night after learning about its importance in the pursuit of financial independence. To me, it feels like something that I should have complete control over, but I’m not sure that’s realistic.

Becoming obsessed with savings rate is not a unique experience. I’m willing to bet it’s kept many of us awake at night after learning about its importance in the pursuit of financial independence. To me, it feels like something that I should have complete control over, but I’m not sure that’s realistic.

It’s a love/hate thing…is this feeling sustainable?

Like so many, I stumbled upon the glory of Mr. Money Mustache years ago, seemingly out of nowhere, and became intrigued. I’ve always been the nerdy type, so percentages and numbers were right up my alley. At the time I was broke, living in “negative net worth” land, and working minimum wage jobs. Getting a full 40 hours a week was reason to celebrate. Coming across his now classic article (The Shockingly Simple Math Behind Early Retirement) lit a fire under my ass.

I was slowly creeping nearer and nearer to my 30’s and I was pretty down in the dumps about not having any “marketable skills.” I knew I wanted to go back to school to acquire some, but I was confused about what direction to take, and I was scared to commit.

(If I’m being honest, I’m still not sure I made the right decision. But at least by understanding the possibilities of FI, and the power of a healthy savings rate, I’m able to have short term focus that is leading to positive change.)

Anyway…

After months of checking out local colleges and asking strangers and friends alike, I settled on a two-year program that offered a good shot at landing a job in my home province in Canada. By researching the job opportunities, I learned that the industry average for starting salaries in this field were between $60 000 and $80 000/year. Coming from someone making $15 000 to $20 000/year, this possibility didn’t feel real. I started frothing at the mouth, fantasizing about seeing my savings rate at 75 or 80 percent.

Well, here I am.

- College = done

- Professional license/ticket = acquired

- Job near my hometown? = affirmative

Last year (2018) I pulled in north of $80 000 (gross) after my first full year on the job. 70% savings rate was within my grasps!

Then, suddenly, I asked myself:

What am I doing?!.

I wasn’t miserable, but I was pinching pennies. I found myself worrying over buying life improving items, such as new sneakers and work boots. I wanted to try writing a blog, or starting a podcast, or maybe opening a Shopify website. Something entrepreneurial, as I had done in the past as a musician. Yet, none of that happened because of the pedestal I had put my savings rate up on. Spending $100 that was not in my budget was too painful to bare, even if that $100 would have equated to an investment in my mental and physical health. At it’s peak, I found myself with a savings rate of 68% (I was determined to raise it 1% per month until 70%) when I decided to pull the plug.

Phew…what a relief!

What was the outcome?

What sort of hedonistic lifestyle did I build?

How fast am I running on the hedonic treadmill?

…not very.

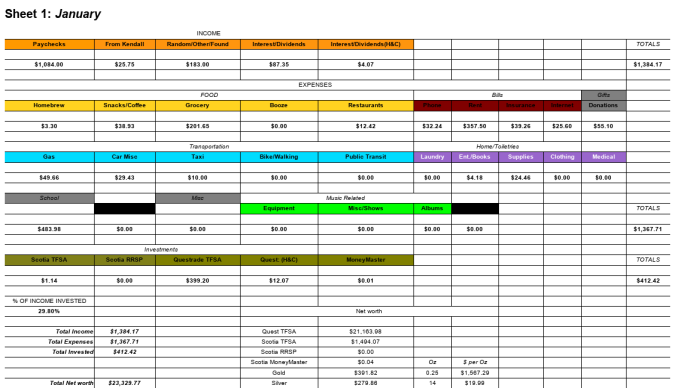

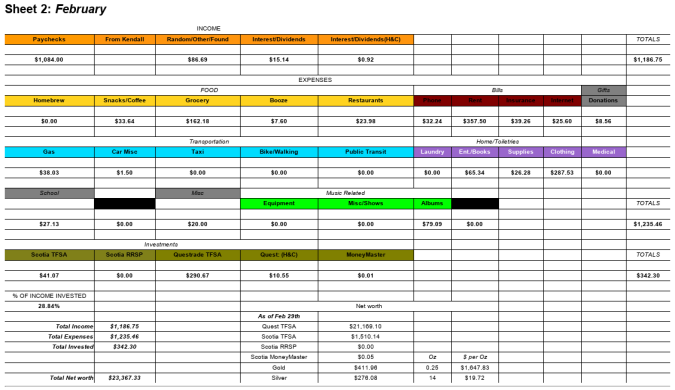

My new savings rate is 50%. Yup, 50%. A year ago that would have sounded laughably low for my personal goals and situation. Not anymore. I’m comfortably saving 50% of my take-home (net) pay.

It’s been about three months now and so far the changes its provided align with my values and pursuits I’ve always wanted. I’ve started looking into building a business with a friend. I’ve purchased a few “.com” addresses (including this one) and am working out some ideas for those. I’ve bought high quality sneakers, which make going for walks way more enjoyable. I bought a new laptop, which I DESPERATELY needed. My wife adores video games, and I love watching random YouTube educational videos and documentaries, so I bought us a new, reasonably sized and priced TV.

All these glorious perks, and I’m still easily and comfortably saving 50%. Amazing.

I did not heed the advice of my other FIER’s that I follow and listen to. Almost all of them, at one point, talked about this situation.

I think it was perhaps the Mad Fientist who suggested that people should experiment with cutting every expense out. Or, whittling down all discretionary spending to it’s absolute minimum. Cut out all treats, all extras, and do it for a few weeks or a month. See how it feels. Then start to bring back spending into the categories that actually provide value.

I knew of this tactic, but I did not follow it. I assumed that because I was use to living on minimum wage, saving 70% would be a no-brainer; an easy accomplishment. If I didn’t reach it I would have been letting myself down, and the two years I was working my ass off in college would have been FOR NOTHING.

I was wrong.

I’m happier now, no doubt about it. I’m still searching for true meaning in my life, but I can honestly say my mind is less clouded by percentages and net worth growth statistics.

Let the journey continue.

Becoming obsessed with savings rate is not a unique experience. I’m willing to bet it’s kept many of us awake at night after learning about its importance in the pursuit of financial independence. To me, it feels like something that I should have complete control over, but I’m not sure that’s realistic.

Becoming obsessed with savings rate is not a unique experience. I’m willing to bet it’s kept many of us awake at night after learning about its importance in the pursuit of financial independence. To me, it feels like something that I should have complete control over, but I’m not sure that’s realistic.